Score

From 0 to 10, the score is the probability, over a12-month period, that a company will be able to meet its financial commitments

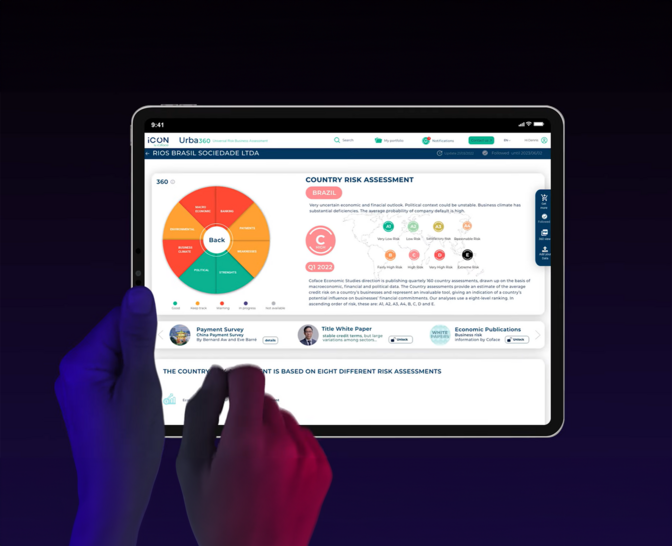

Evaluate business indicators with URBA360, our global risk analysis tool.

URBA360 is the ultimate platform for confident trade decisions. Access Coface’s unique data and expert insights on millions of companies in 190+ countries.

We merge precise data with expert opinions on credit risk, enabling you to evaluate and track customers, suppliers, and partners effortlessly with URBA360.

Anticipate the risk of default with our all-in-one solution:

Our expertise is unique because based on over 75 years' experience in credit insurance:

Our Credit Insurer Insights are made available to our customers so they can make the best decisions for their business:

Coface’s Monitoring solution is your Real-Time business guardian.

Each time Coface detects a change on a monitored company of your portfolio, you are notified immediately:

> Track critical data, anticipate risks, and seize opportunities – all in real-time.

> Safeguard your business success with Coface Monitoring.

URBA360 is an intuitive and interactive web application that provides access to Coface's exclusive data for assessing commercial risk worldwide.

Accessible via the iCON by Coface platform, URBA360 enables users to explore indicators such as the Coface Score, @Credit Opinion and country or sector risk assessments.

Welcome to the future of informed decision-making! Explore the power of iCON by Coface.

Explore Coface API catalogue: integrated solutions for Trade Credit Insurance and business information.

Online services for customers and brokers

Business Information

Access the business insights you need to manage credit risks across your entire business-partner portfolio and make strategic decisions with confidence.

Customer Portal - CofaNet

Coface online platform for managing your trade receivables. Full monitoring of your risks. Direct access to all tools according to your contracts.

Broker Portal

Platform dedicated to brokers for monitoring your business and managing your customer portfolio (in all countries where legally available).

Innovative and digital solutions

API Portal

Stop juggling between software applications. Explore Coface API Catalogue and Integrated Solutions for Icon by Coface and trade credit insurance.