Nearly two decades after joining the BRICS, South Africa has failed to deliver on its development promises. Per capita GDP in 2025 is below 2007 levels, with a marked deterioration in social indicators: unemployment, growing poverty and severely degraded infrastructure. Unlike its emerging peers in Asia and Latin America, the ‘Rainbow Nation’ has remained mired in low growth, hampered by two major structural constraints: the failure of the energy system and deep distortions in the labor market.

South Africa is at a critical crossroads. The country has the assets to bounce back – a diversified industrial base, a strong financial sector, credible institutions – but it is hampered by structural problems in energy and employment. Without deep and sustained reforms, growth potential will remain permanently constrained. We forecast growth of 0.8% in 2025 and 1.3% in 2026.

Aroni Chaudhuri, Coface economist for Africa

From the hope of the 2000s to post-pandemic disillusionment

Buoyed by soaring commodity prices and its successful integration into global trade, South Africa enjoyed average annual growth of 4.3% in the 2000s. Investment was buoyant, household consumption was strong, and the country seemed poised for rapid development alongside other emerging economies.

But three successive crises – the 2008 financial crisis, the end of the commodity super cycle in 2014, and then the pandemic – exposed deep structural weaknesses. Today, investment is sluggish, accounting for only 14.5% of GDP, which is insufficient to stimulate the economy and renew existing infrastructure, and well below the levels of comparable countries.

The energy crisis: a major obstacle to growth

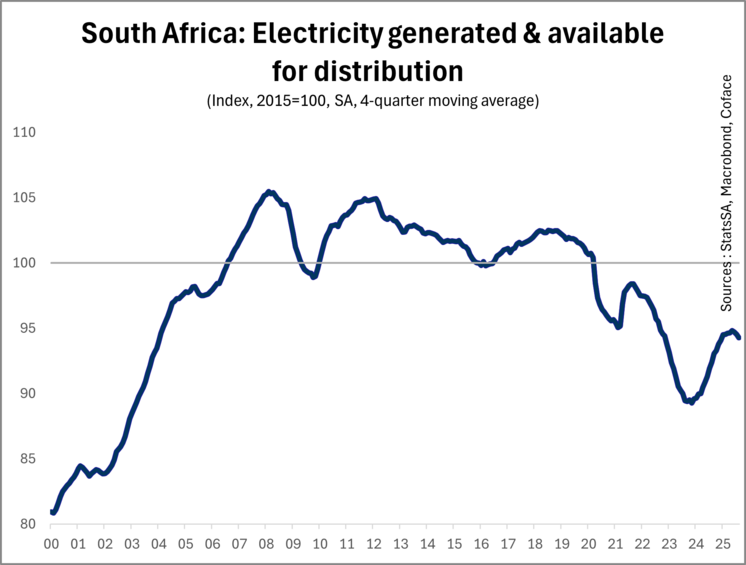

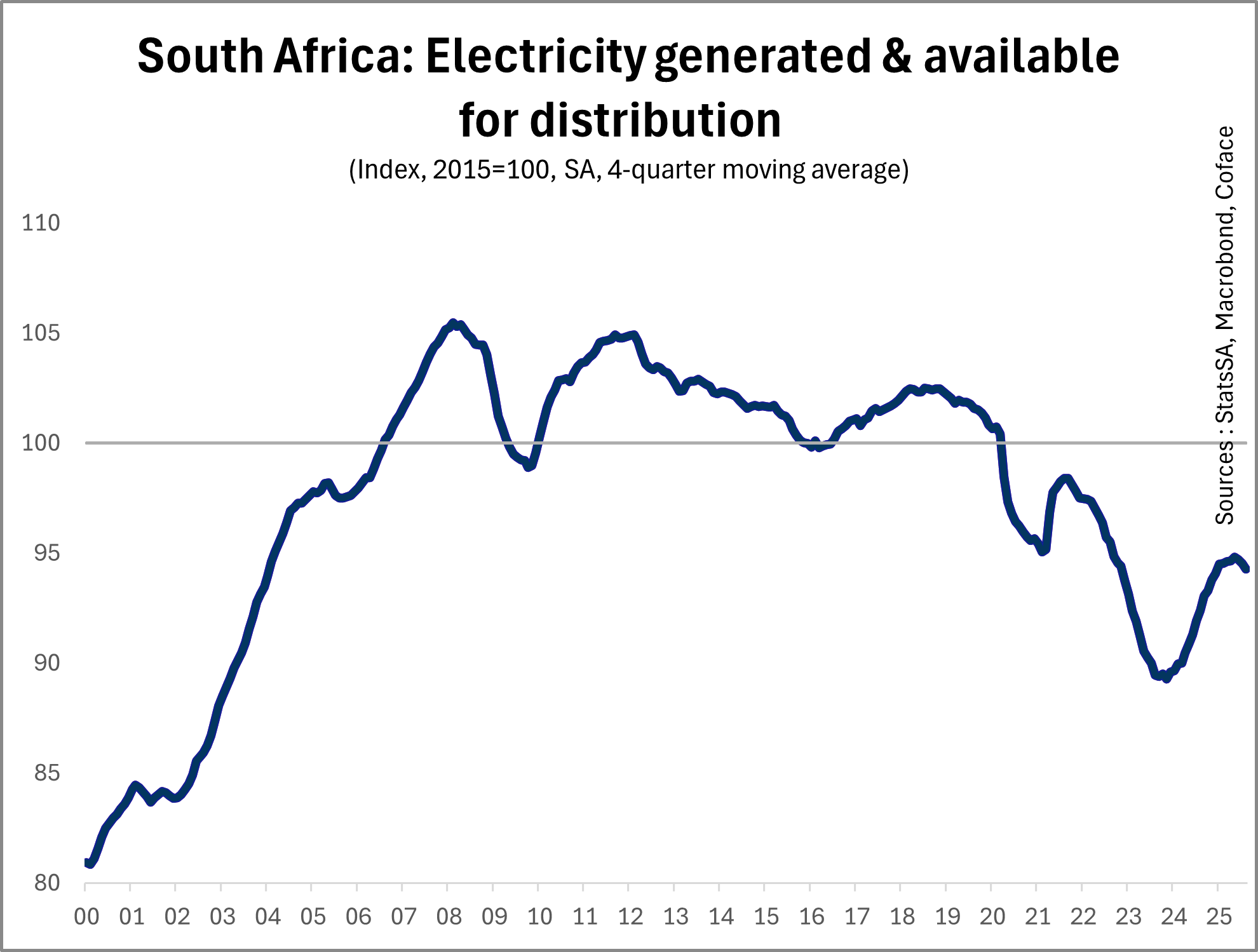

Electricity, the backbone of the South African economy, has become its Achilles heel. Eskom, the public monopoly that controls more than 90% of production, has suffered from chronic underinvestment for more than a decade. Real investment spending fell from 2012 onwards and did not recover in time.

This situation has its roots in inadequate tariff regulation and poor governance. Until 2008, electricity prices were kept artificially low to support energy-intensive industries. By the time the authorities finally adopted a more realistic tariff policy, it was already too late: ageing infrastructure was causing more and more outages, demand was falling, and Eskom found itself trapped in a vicious circle of debt. Between 2008 and 2019, tariffs quadrupled without solving the supply problems.

(source data for the graph in .xls format)

The consequences are disastrous: massive load shedding paralyzing economic activity, destruction of productive capacity, flight of private investment and deterioration of public finances. State-guaranteed debt for Eskom has exploded, contributing to an increase in the public debt-to-GDP ratio from 28% in 2007-2008 to 76% in 2024-2025.

A deeply unbalanced labor market

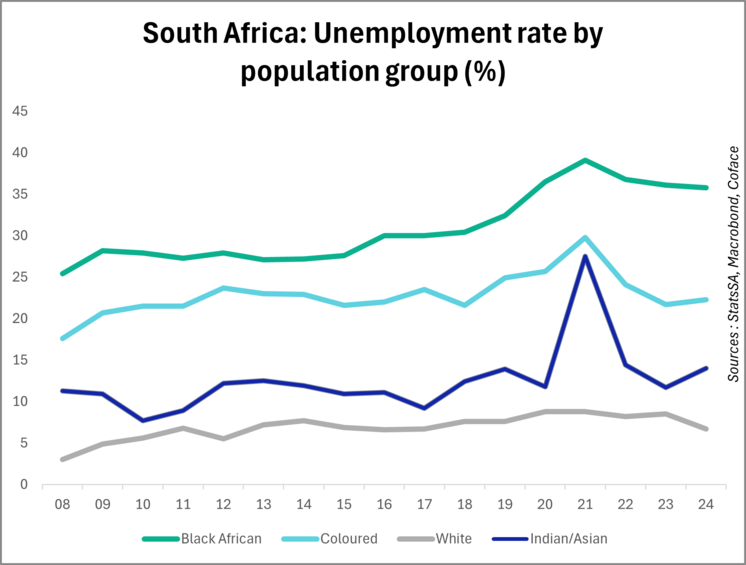

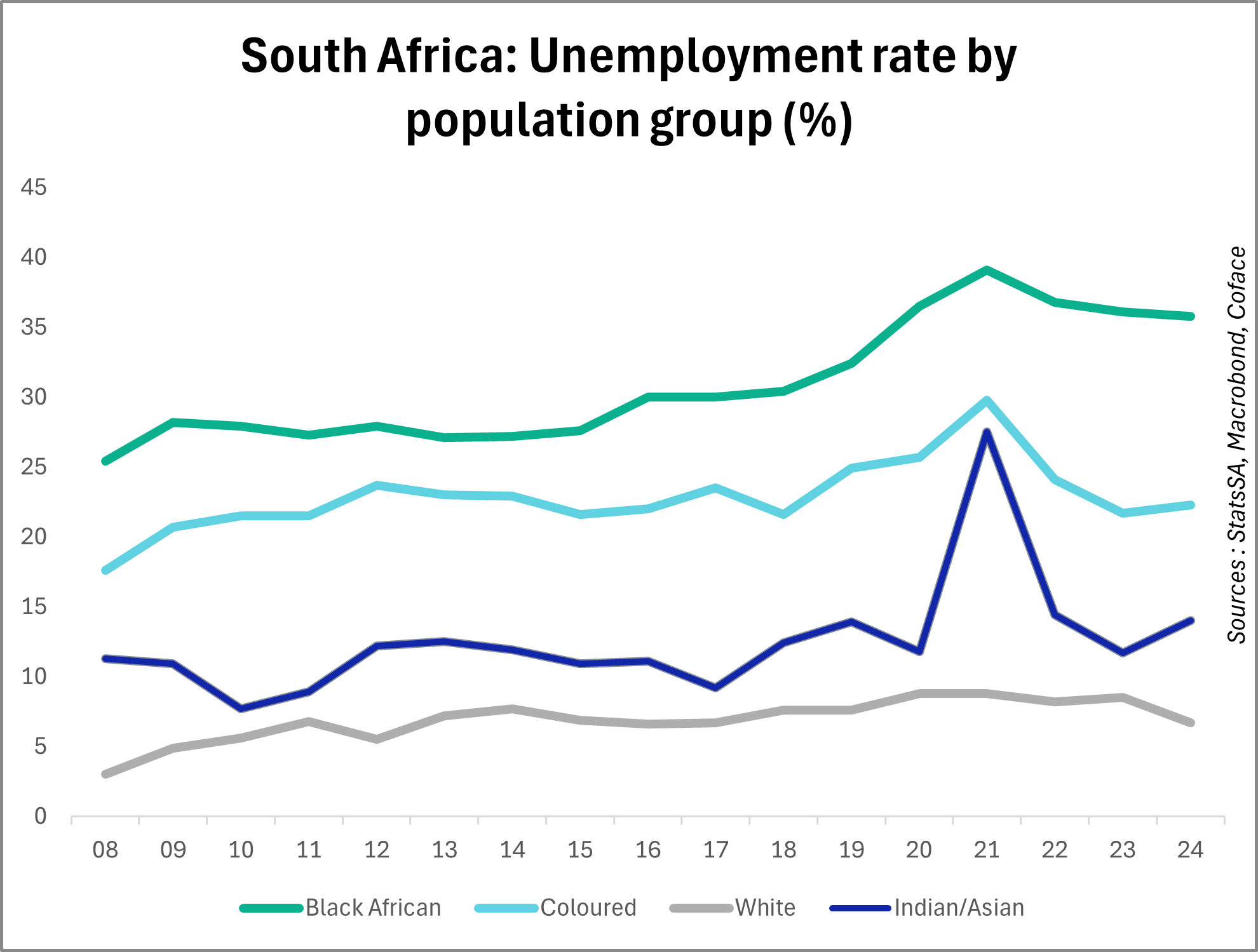

The second major obstacle is the labor market. With an unemployment rate of 33.2% in the second quarter of 2025, South Africa has one of the highest levels in the world. This situation is the result of a toxic combination of factors: ongoing deindustrialization since 2008, a mismatch between the supply and demand for skills (42% of the working population has no secondary school qualifications), and above all, the territorial legacy of apartheid, which keeps a large part of the population far from economic centers.

Despite the end of apartheid more than 30 years ago, spatial segregation persists. Township and disadvantaged areas remain far from employment centres, with prohibitive transport costs and inadequate infrastructure. This territorial fragmentation creates structural exclusion, which keeps labour force participation abnormally low and limits the effectiveness of any employment stimulation policy.

(source data for the graph in .xls format)

Prospects for improvement still uncertain

Faced with these challenges, however, there are some positive signs. The arrival of a coalition government in 2024 marks an unprecedented political turning point and could introduce greater pluralism and oversight. Major reforms have been launched to restructure Eskom, increase private sector participation in energy, and ease regulatory constraints on businesses.

But the road ahead will be long. Even with ambitious reforms, it will take several years for South Africa to regain its potential as a dynamic and promising emerging economy, as envisaged in the 2000s. To achieve this, the country still has considerable assets: the most developed industrial base in Africa, a sophisticated financial sector, a credible central bank, and full integration into global trade and financial circuits. If structural constraints are lifted, South Africa could capitalize on African regional growth and regain its place as a continental power.